$DB $ETH

#DeutscheBank #Zksync #Blockchain #Compliance #TradFi #Innovation #Scalability #Crypto #Finance #Technology #Banking #Layer2

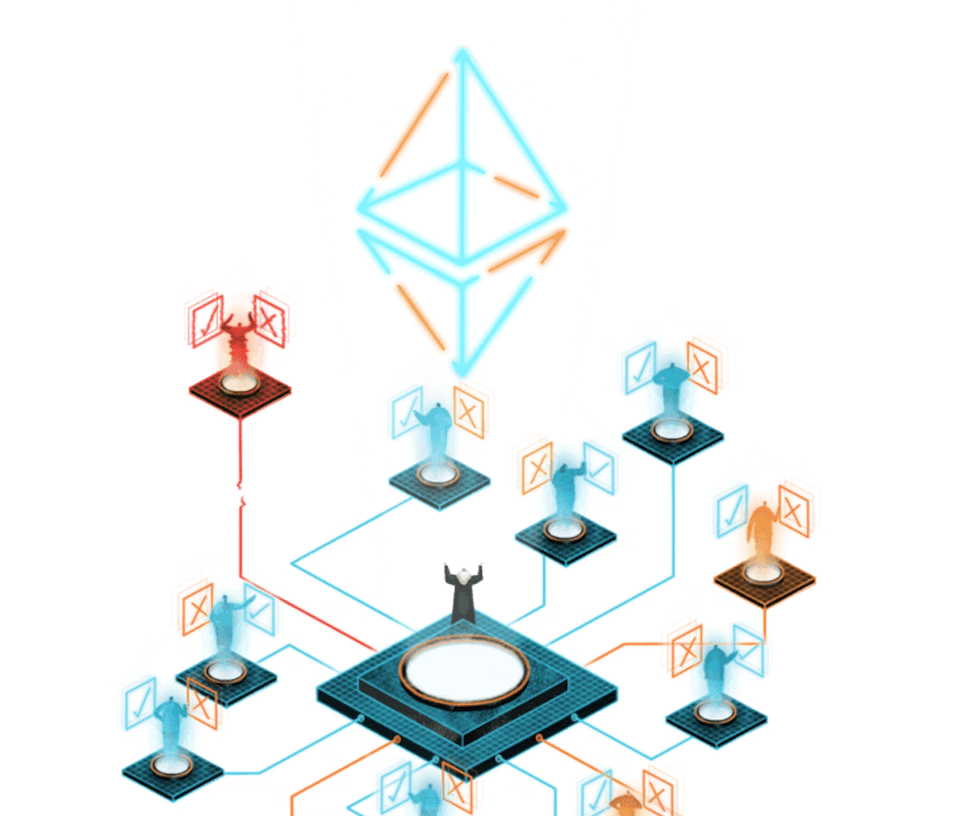

Deutsche Bank, one of the world’s leading financial service providers, has embarked on a groundbreaking initiative to bridge the gap between traditional finance (TradFi) and the rapidly evolving blockchain ecosystem. Recognizing the potential of blockchain technology to transform the financial sector, Deutsche Bank has launched a Zksync-based Layer 2 solution aimed at overcoming some of the main hurdles that have hindered broader adoption, particularly in the realm of regulatory compliance.

This innovative Layer 2 protocol leverages the power of Zksync to provide a platform that is not only cost-effective but also highly secure, addressing major concerns for institutions operating in the TradFi sector. By solving compliance challenges, Deutsche Bank is setting a precedent for how legacy financial institutions can integrate blockchain technology into their existing frameworks without compromising on legal and regulatory responsibilities. This move is seen as a strategic effort to foster innovation and scalability in the financial industry, paving the way for new forms of investment, financial products, and services.

Furthermore, the adoption of a Layer 2 solution highlights Deutsche Bank’s commitment to staying at the forefront of technological advancements in finance. Layer 2 solutions are designed to operate on top of existing blockchain networks, enhancing their scalability by processing transactions more efficiently and at lower costs. This approach not only mitigates the congestion often experienced on main blockchain networks but also significantly reduces transaction fees, making blockchain applications more accessible for a wider range of users and applications.

Deutsche Bank’s initiative is a significant step forward in the convergence of traditional finance and blockchain technology. By leveraging Zksync-based Layer 2 solutions, the bank not only demonstrates its capacity to innovate within the strict confines of financial regulations but also highlights the potential for blockchain technology to enhance the security, efficiency, and scalability of financial services. As other institutions observe Deutsche Bank’s foray into blockchain-enhanced financial solutions, we may see a ripple effect, encouraging further adoption across the sector and potentially leading to more collaborative efforts between traditional financial entities and the blockchain world.